PAN Card

Different taxpayers in the nation can be identified using their Permanent Account Numbers, or PANs. A 10-digit unique identity alphanumeric number called a pan card is given to Indians, typically to those who pay taxes.

Every Indian tax-paying entity is given a unique identification number through the computer-based PAN system of identification. By using this technique, a person's whole tax-related information is stored against a single PAN number, which serves as the main key for information storage. Since this is shared throughout the nation, no two individuals on tax-paying entities may have the same PAN.

The Income Tax Department also issues PAN Cards when a PAN is assigned to an entity. While PAN is a number, PAN Card is a physical card that also contains your name, date of birth, father's or spouse's name, and a photograph in addition to your PAN. You may provide copies of this card as identification or date-of-birth evidence.

Due to the fact that it is unaffected by any address changes, your PAN Card remains valid for life.

The deadline to link PAN and Aadhaar card is March 31, 2023.

The final day to link your PAN to your Aadhaar is now March 31, 2023. However, there will be a fee of Rs. 500 for anyone who fail to link their PAN and Aadhaar by March 31, 2022.

How to link Aadhaar with PAN online

- Visit the official e-Filing website by clicking here.

- e-Filing website's pre-login page (for both registered and unregistered users)

- following e-Filing portal login (for registered users)

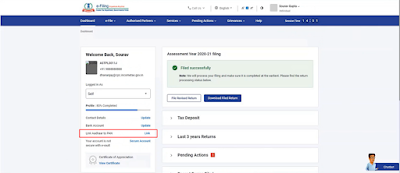

The e-Filing homepage allows you to check your Link Aadhaar status.

Conditions needed to use this service

- PAN and Aadhaar number that is valid and belongs to same person.

- Authentic cellphone number registered with Aadhaar or PAN.

Two key steps are required to link an Aadhar number to a PAN:

- Login/ sign up with required credentials from this official e-Fliling website.

- post login, link your pan and Aadhaar with detailed explanation given below.

Detailed work flow -

- Register on the official website (if not already done). Your PAN (Permanent Account Number) is the user id for logging in.

- Log in to the portal by entering the User ID, password and DOB (Date Of Birth).

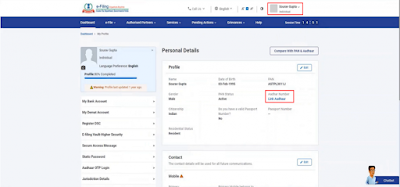

- Go to ‘Profile Settings’ tab from the Menu bar and then click on ‘Link Aadhaar’.

- All the details such as name, DOB and gender will already be fetched and displayed as per the PAN details/records.

- Now once verify the PAN details on screen with your Aadhaar details.

- If the details are matching including name, surname, then enter your Aadhaar number and click on the “link now” button.

- A pop-up message on the screen notifies you that your Aadhaar has been successfully linked to your PAN.

.png)

Comments

Post a Comment